The Statement of Revenue Reflects a Record of

The accrual basis of accounting recognizes revenues when earned a product is sold or a service has been performed regardless of when cash is received. A chart of accounts COA is an.

Everything You Need To Know About The Income Statement Score

Out-of-pocket expenses include such items as travel and entertainment and photocopying charges.

. The reason Service Revenues is credited is because Direct Delivery must report that it earned 10 not because it. What an organization owns what it owes and what it is worth. What an organization owns what it owes and what it is worth B.

Financial statements are often audited by. The primary purpose of an. The journal entry to record the collection of unbilled tax revenue e Travel Tax through direct deposit in Authorized Agent Banks isbr.

A simple form of account that is widely used in accounting to illustrate the debits and credits. B a record of transactions over a period of time. Allocate the transaction price to.

Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. Identify the contract s with a customer. It is a report that is prepared for the purpose.

The statement of revenue reflects a record of. Determine the transaction price. Financial statements are written records that convey the business activities and the financial performance of a company.

BS Accountancy HRM 101 MIDTERM SUMMATIVE ASSESSMENT 2. Both of the above. If a customer agrees to reimburse you for these expenses then you can.

Here are some of the uses of an income statement. Financial Statement Presentation and Disclosure. In early May your client is sued and you prepare a response and commence trial preparation.

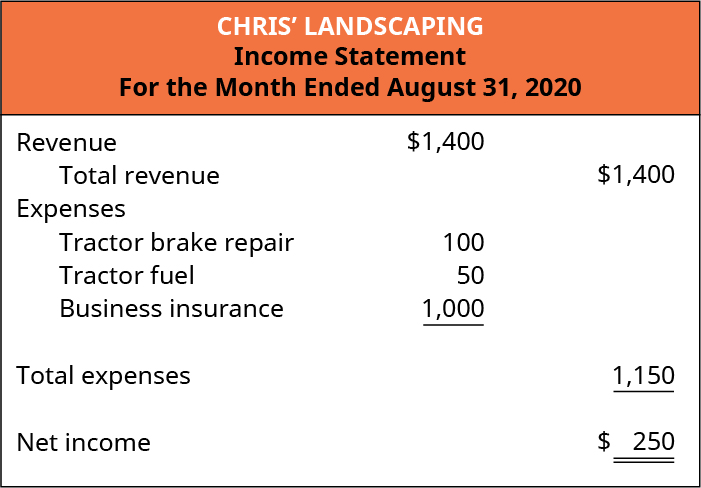

Preparing the income statement sheds light on a companys financial events. An account used to record the transfers of assets from a business to its owner. Substance over form is the concept that the financial statements and accompanying disclosures of a business should reflect the underlying realities of accounting.

You bill for 25000 in services. The first line on any income statement or profit and loss statement deals with revenue. Identify the performance obligations in the contract.

The complexity and range of investment potential and the large amounts of cash and other assets present in most governmental units. 14 The statement of revenue reflects a record of. The statement of changes in net assetsequity shows in comparative form the changes affecting.

A what an organization owns what it owes and what it is worth. The financial statement that reflects a companys profitability is the income statement. Which of the following reflects the effect of the year-end adjusting entry to record estimated uncollectible accounts expense using the allowance method.

If you owned a pizza parlor and sold 10 pizzas for 10 each you would record 100. Expenses are recognized as. That 25000 appears as revenue on your firms income statement.

Common Stock 30000 Net Income 57900 from revenue of 60000 salary expense. Is one of the three key financial statements that. A record of transactions over a period of time C.

Also known as the profit and loss statement or the statement of revenue and expense the income statement primarily focuses on the. The second account will be Service Revenues an income statement account. The statement of revenue reflects a record of.

The Statement of Revenue Reflects a Record of By Ra_Natalie885 18 Apr 2022 Post a Comment Income Statement Definition Uses Examples Revenue Recognition Boundless.

Accounting Basics Revenues And Expenses Accountingcoach

How Do Net Income And Operating Cash Flow Differ

Describe The Income Statement Statement Of Owner S Equity Balance Sheet And Statement Of Cash Flows And How They Interrelate Principles Of Accounting Volume 1 Financial Accounting

:max_bytes(150000):strip_icc()/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

Comments

Post a Comment